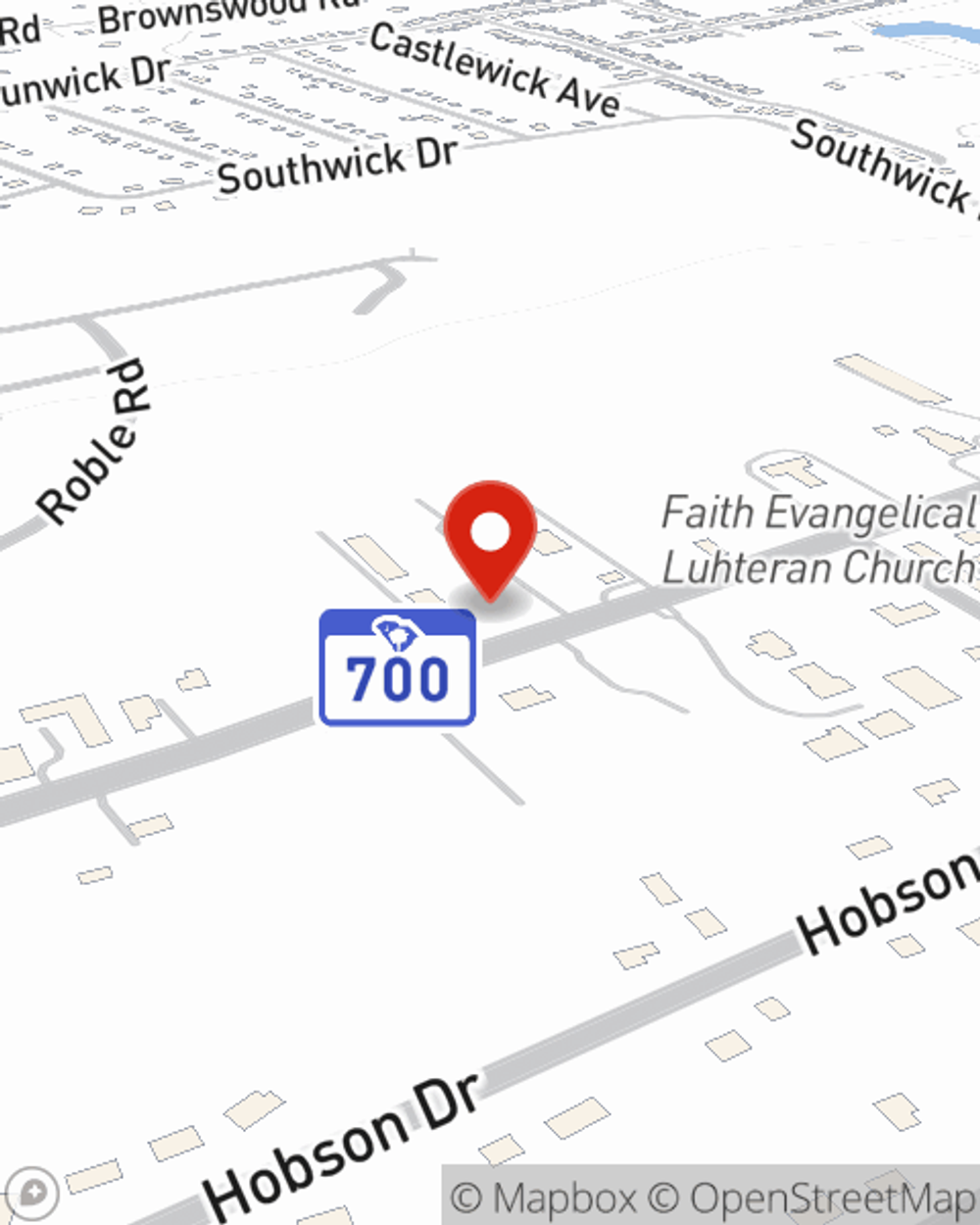

Renters Insurance in and around Johns Island

Renters of Johns Island, State Farm can cover you

Renters insurance can help protect your belongings

Would you like to create a personalized renters quote?

- Johns Island

- Charleston

- North Charleston

- West Ashley

- James Island

- Mt. Pleasant

- Wadmalaw Island

There’s No Place Like Home

No matter what you're considering as you rent a home - furnishings, outdoor living space, number of bathrooms, house or condo - getting the right insurance can be vital in the event of the unanticipated.

Renters of Johns Island, State Farm can cover you

Renters insurance can help protect your belongings

State Farm Has Options For Your Renters Insurance Needs

When the unanticipated tornado happens to your rented townhome or property, often it affects your personal belongings, such as a stereo, sports equipment or a tool set. That's where your renters insurance comes in. State Farm agent Emily Adams has the knowledge needed to help you choose the right policy so that you can protect your belongings.

It's never a bad idea to be prepared. Get in touch with State Farm agent Emily Adams for help understanding options for your policy for your rented home.

Have More Questions About Renters Insurance?

Call Emily at (843) 737-4910 or visit our FAQ page.

Simple Insights®

How do I know how much renters insurance to buy?

How do I know how much renters insurance to buy?

For renters insurance, finding the right balance means choosing accurate, appropriate limits for your personal property and liability coverage.

Is bundling insurance worth it?

Is bundling insurance worth it?

Bundling insurance, such as auto and home, can be a great way to get discounts, but that’s not all! Discover why bundling makes sense for savings and more.

Emily Adams

State Farm® Insurance AgentSimple Insights®

How do I know how much renters insurance to buy?

How do I know how much renters insurance to buy?

For renters insurance, finding the right balance means choosing accurate, appropriate limits for your personal property and liability coverage.

Is bundling insurance worth it?

Is bundling insurance worth it?

Bundling insurance, such as auto and home, can be a great way to get discounts, but that’s not all! Discover why bundling makes sense for savings and more.